How to Sell Stock On Cash App – Quick and Simple Steps

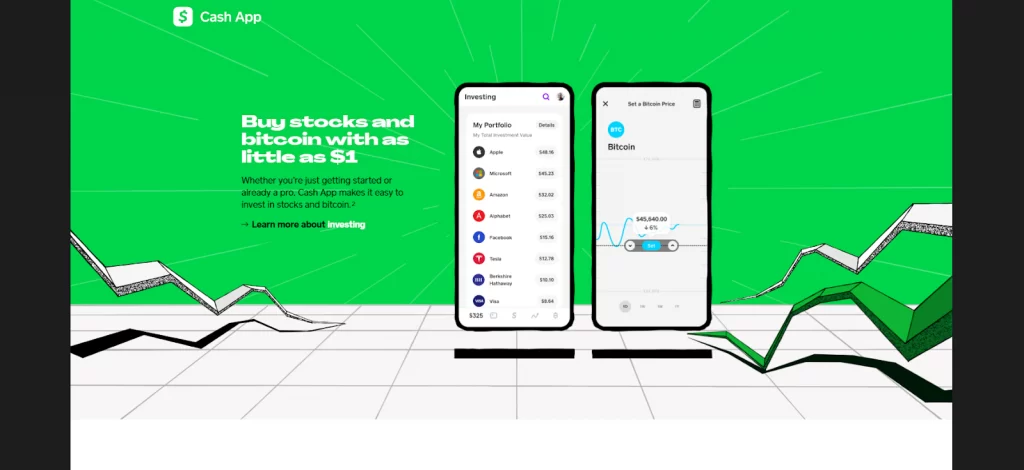

If you want to invest, purchase, sell stocks, and trade in partial shares of stocks, then Cash App Stock is the perfect solution for you.

If you’re a beginner investor in Cash App, this guide is for you. We’ll answer all your questions and discuss how you can sell stock on Cash App.

Table of Contents

- Is It Good to Sell Stock On Cash App?

- How Do Stocks Work On The Cash App?

- How to Buy Stock On Cash App

- How to Sell Stock On Cash App

- How Long Does it Take to Sell Stock On Cash App?

- Pros and Cons of Cash App

- How to Withdraw Money From a Cash App Without a Card

- FAQs

- Summary

Is It Good to Sell Stock On Cash App?

Is Cash App Good for trading stocks?

Absolutely!

Cash App is a safe investing app that’s made with beginner investors in mind. It’s a perfect starting point for those looking to dip their toes into the stock market.

However, it’s not recommended if you’re a well-established, experienced investor who prefers to take a closer look at stocks and other stock tools.

This is because Cash App isn’t a full-on trading app with access to third-party stock research. It’s more suitable for beginners because of the lack of commissions.

Beginner investors can invest small amounts through fractional share buys. If you want to use this app for IRAs and other investments, you may want to look elsewhere.

Watch this video to learn more about Cash App investing:

How Do Stocks Work On The Cash App?

You can easily buy and sell stock on Cash App using the money in your balance. However, if your funds aren’t sufficient, the remaining amount will be charged from your linked card.

Once your order is completed, you can see your investment by clicking the Investing tab on your home screen and scrolling down to your portfolio. You can make purchases and sales Monday through Friday during NYSE Market Hours.

How to Buy Stock On Cash App

The buying process takes only a few easy steps. Just open the Cash App. Click on the Investing tab. Then, pick the search bar and type in a company’s ticker symbol or stock name.

Select the company you want to purchase the stock from. Then, click the Buy option and enter a custom amount for the stock. Next, follow the provided instructions to verify your information.

Confirm the transaction with Touch ID or your Cash App PIN.

It’s that easy! Now, let’s learn how to sell stock on Cash App. It’s a bit more complex but still relatively simple.

Read our related article, Cash App GME: Can You BUY Gamestop Stock On Cash App? for more information on stocks available (or not available) on Cash App!

Watch this video to learn how to buy stocks on Cash App:

How to Sell Stock On Cash App

Can I sell my stock on Cash App? Yes!

To sell stock on Cash App, first launch your Cash App on your smartphone. Select the Investing tab from the home screen. Then, scroll down to the My Portfolio option. This is where things get a little complicated.

To sell stock on Cash App, you need to have it in your portfolio. A portfolio is a group of stocks you have on a specific platform.

Other apps have different storage spots. However, Cash App has a portfolio, so make sure that the stock you want to sell is available in your portfolio before taking the next step of the process.

Pick the company whose stock you want to sell. Simply click the company’s ticker once you decide what stock to sell. Once you’re done, you’ll be transferred to another page with a Sell option. Click the Sell button and define how much stock you wish to sell.

You can either share value or do this with a dollar since Cash App provides fractional investing. Meaning, you can either enter a custom amount or select a preset amount. Then, the app will ask that you type in your Touch ID or Cash App PIN to finish the process.

This request is just an additional layer of protection for your investment. Your Touch ID or Cash App PIN can protect your account from theft and fraud. Once finished, go back to your homepage.

After you sell stock on Cash App, the money lands in your account. You can easily check your money in your balance, though keep in mind that the process can take between a few hours and 2 business days to complete.

Watch this video to learn more about how to sell stocks on Cash App:

How Long Does it Take to Sell Stock On Cash App?

The funds of the stock sale will land into your Cash App account and you can easily see it in your balance once you sell stock on Cash App.

However, keep in mind that in some cases, depending on the market activity, your money can take up to 2 business days to complete and land in your account.

If you’re a new investor, check out the following rules and make well-informed choices. For instance, learn about the trading limits and taxes.

Read our related article on How to Get 1099 k From Cash App and file your taxes correctly!

Trading Limits

Cash App has a few trading limits.

For instance, if you sell stock outside of market hours 9:30 AM-4:00 PM ET on the weekend (excluding federal holidays), your sell won’t complete until the market opens again.

Cash App has day trading limits just like most brokerages.

According to their guidelines, when you purchase a stock using Cash App investing, you’re restricting the buying power of your balance and your add money limits.

Have you ever heard of day trade?

We’ll discuss this more in detail in the FAQs section but in short, a day trade is considered purchasing and selling the same stock on the same day.

Cash App limits you to 3 day trades within a rolling 5 day trading period. Furthermore, if you break these rules, your ability to day trade could be suspended or even terminated.

As long as you follow the rules, you’ll be fine.

Capital Gains Taxes

Don’t forget about the taxes on both long-term and short-term capital gains.

If you’re gaining money, don’t forget to save some of that cash for tax season. Trades kept for less than 1 year get higher tax rates, and capital losses can be disregarded up to $3,000 per individual.

Read our related article, Cash App Tax Refund Deposit PROCESS (Step-by-Step). If you’re expecting a tax refund, see how you can get it deposited directly into your Cash App with this guide!

Pros and Cons of Cash App

Cash App makes a perfect option for new investors to start investing small amounts through fractional share buys.

However, just like with anything else, Cash App has good and bad sides. That being said, let’s summarize the key pros and cons and determine if it’s suitable for your needs.

Pros

- No commission fee

- Straightforward setup

- You can buy and sell Bitcoin

- Different money management features

- Effortless mobile payments

- No fees on basic services

- Beginner-friendly

Cons

- Limited account types

- Limited to just ETFs and Stocks

- There’s a fee to send money through a credit card

- Not made for professional traders

- Fee for instant deposits

With this app, you should have knowledge of what you’re really investing in before you start purchasing random stocks. You can buy fractional shares for certain money amounts (increments by $1, $5, $10, etc). At the moment, this app doesn’t offer a variety of investment options.

For instance, there’s no option for bonds or mutual funds. These are more common among experienced investors. This is why Cash App is highly recommended for beginner investors.

The best part? You can open a Cash App investing account for free without a minimum balance to keep. You won’t have to pay any commission fees except for fees required by the SEC and obligatory sale fees.

Overall, it’s perfect for stock trading, but not so much for branching out.

How to Withdraw Money From a Cash App Without a Card

It’s easy!

Just launch your Cash App on your smartphone. Then, click on your balance option on the bottom left portion of the app.

You’ll be redirected to a new page with different options among which you’ll notice the Cash-Out option.

Click that option and type in the desired amount you want to cash out. Then, click the green button that says Cash-Out and pick one of the two available ways to complete the transfer. One is a paid instant while the other costs no money.

If you opt for the free cash-out option, you’ll have to wait 2-3 business days to get your money. If that’s not a big deal to you, choose the free option.

Once you’re done with this, you’ll be asked to enter your PIN or fingerprint ID. Then, you’ll need to link your bank account, which is pretty straightforward.

Once you enter your bank account, your bank will ask you to confirm your identity by sending a security code. Just enter the code you received and you’ll get your money in a couple of days.

If you pick the instant way, you’ll have to pay a fee. This process requires a debit card, so it’s not suitable for customers who don’t have a card.

However, it’s convenient for those who do have a card and need their money ASAP.

See our related article about How to Get Money off Cash App Without A Card. Learn the step-by-step process of how you can get money off Cash App even if you don’t have a card.

FAQs

Q: How Much Does it Cost to Sell Stock On Cash App?

A: Opening a Cash App investing account to sell stock on Cash App is 100% free.

Additionally, Cash App doesn’t charge commission fees when you purchase stock. So, you’ll pay $0 for purchasing stock. However, when you sell stock on Cash App, there’s a regulatory fee of $0.01 for selling stock. This is a government mandatory fee.

To sell stock on Cash App, you’ll have to pay the same fee whether you’re selling $1,000 or $10.

Q: Does Cash App Have a Sell Limit On Stocks?

A: The minimum sale amount to sell stock on Cash App is $1.

You can either sell some or all of the stock that you have. However, if you put in a sell request that’s close to the total amount available in your account (98% or over), you must either sell all of your stock or pick a lower amount to sell.

For instance, if you have $100 in stock ABC and try to sell $98, you’ll either need to sell all $100 or pick a number lower than $98.

Q: What is a Day Trade?

A: A day trade is when you purchase and sell stock on Cash App the same day.

Keep in mind that the order isn’t that important, so if you were to put in a sell request of stock, followed by a purchase of the same stock on the same day, this would still be perceived as a day trade.

Q: Can I Still Buy and Sell Stock if I Hit My Day Trade Limit?

A: If you hit the day trade limit, you can still purchase and sell stock but you shouldn’t place a day trade.

Q: When Will My Day Trade Limit Reset?

A: The 5-day trading time is formulated when the market is open (usually Monday-Friday, 9:30 AM-4 PM EST, excluding federal holidays).

Keep in mind that this period is based on market days only. Meaning, holidays and weekends aren’t included in these 5 days.

Q: Can I Buy Penny Stocks on Cash App?

A: A penny stock is a stock of a small company that usually trades for less than $5 per share. Cash app provides access to certain penny stocks to meet the standard that’s traded on large trade exchanges like the NYSE (New York Stock Exchange).

Q: Do You Have to Pay Taxes On Cash App stocks?

A: Unfortunately, you have to pay taxes on Cash App stocks.

This app is required by law to file a copy of the Composite Form 1099 to the IRS for the applicable tax year. The IRS sees your income collected on this app as just another transaction on a regular bank account.

Read our related article, Does Cash App Report Personal Accounts to the IRS? for more information.

Summary

Buying and selling stocks is an exciting venture for many people. Investing in Cash App stocks is a great venture for enthusiastic new investors because of the easy process.

Hopefully, this guide has helped you learn more about Cash App and how to sell stock on Cash App.