The Best No Interest Credit Cards for 12 Months

Interest is the fee you pay for the privilege of borrowing money. Credit cards allow you to borrow money from your card issuer which in most cases must be repaid-with interest. However, some card issuers can exempt interest for new applicants for a certain period such as 6 months, 12 months, 18 months, 24 months, and so on. In this article, we shall discuss the no-interest credit cards for 12 months.

The interest rate is normally expressed as an annual percentage rate (APR). It is the annual rate charged for borrowing. Also, APR can be termed as the amount earned through investment within a year. Before getting any credit card, you should ensure that you understand the APR rates so that you do not get into an expensive deal with your financial institution. It should act as the base of comparison between different cards among other factors.

Credit card interest rates vary with someone’s credit scores and history. Credit cards with low APRs require people with good credit history which means high credit scores. For instance, credit cards for bad credit with no deposit charge high-interest rates. This is because there are high risks associated with the applicants of such cards. Bad credit cards with deposit charge friendly interest rates since the deposit acts as the security.

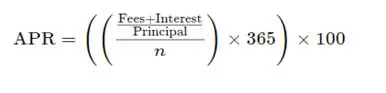

How is APR calculated?

APR is calculated by multiplying the interest rate by the number of periods in a year. If the rate is charged monthly, then there will be 12 periods in a year. Use this formula to calculate your APR.

Where:

Fees= monthly fees, annual fees, and transaction fees

Interest= Total interest paid over the life of the loan

Principal= Loan amount

n= Number of days in the loan term

What are the different types of APRs?

There are two main types of APRs. These include fixed and variable APR. a fixed APR can increase within 45 days of notice while variable APR can increase anytime without notice depending on the index interest rate. However, within the two major types of APRs, there are other types which include the following.

i) Purchase APR

This is the interest rate you pay on purchases you make if you carry a balance on your credit card.

ii) Balance Transfer APR

Balance Transfer APR refers to the interest rate you pay upon moving debt/s from one or more credit card accounts to a different one with better rates. For example, if you had a small business credit card for bad credit but have improved your credit scores, you can upgrade to a better card with lower interest rates and rewards.

iii) Promotional APR

This is a low-interest rate offered on a credit card balance for certain duration.

iv) Cash Advance APR

This is the interest you pay when you borrow cash on the credit card account. The interest rate is normally very high.

v) Penalty APR

It refers to the interest rate charged when you fail to pay your debts on the due date. It is normally high as compared to the normal interest rate. In most cases, falling behind the repayment date disqualifies you from benefits such as promotional APRs.

Can I get a 0% interest rate credit card with bad credit?

It is rare to get a 0% interest rate card if you have bad credit. I have not heard of one. However, some credit cards for fair credit with high limits can reward you with a one year, two years, and so on interest-free borrowing.

If you have bad credit, you will have to get a bad credit card, improve your scores, and maybe get a good credit card with a 0% interest rate for a specified period.

Do credit cards have an overdraft?

Credit cards do not have overdrafts. Once you exhaust your credit limit, you cannot spend anymore. However, some cards may have an option where you can opt-in for additional expenditure above your credit limit.

Overdrafts are common with debit cards. If you spend all your money in your account, your bank may allow you to borrow a certain amount of money that you have to pay later. Most banks make automatic deductions when you receive money in your account.

Is it easy to get a credit card with bad credit?

Most financial institutions are reluctant to give credit cards to people with bad credit scores. However, some institutions have guaranteed approval credit cards for bad credit as long as you meet their requirements.

Which are the best no interest credit cards for 12 months?

If you are looking for a credit card that will not charge you any interest rate for the first year of usage, then you can choose any of the following.

1) Chase Freedom Unlimited®

The card has 0% Intro APR on purchases for the first 15 months. Get the card and earn a $200 Bonus upon spending $500 on purchases in the first 3 months of account opening. In addition, you will earn 5% cash back on grocery store purchases (excluding Target® or Walmart®) after spending up to $12,000 in the first year of the credit card acquisition.

Also, you will be able to earn unlimited 1.5% cash back on all other purchases. Again, the card will earn you 5% on travel purchases through Chase, 3% on drugstores, and restaurants. Interestingly, the card has no annual fee. A good/excellent credit is needed. Learn more.

2) Capital One® Quicksilver® Cash Rewards Credit Card

Upon getting the card, you will benefit from a one-time $150 bonus when you spend $500 on purchases within 3 months of account opening. Also, you will earn unlimited 1.5% cash back on an everyday purchase you make with the card. The card has 0% intro APR on purchases for 15 months and thereafter, 15.49%-25.49% variable APR.

Interestingly, there is no limit on how many rewards you can get. The rewards do not expire either. Also, the card does not charge any annual fee nor transaction fees. Transfer money using the routing number and account number to your friends and family using this card and spend less. You need a good/excellent credit scores to apply for the card. Learn more.

3) Chase Freedom Flex

The card has no annual fees. It allows you to earn a $200 Bonus upon spending $500 on purchases in your first 3 months of account opening. Also, you will earn 5% cash back on grocery store purchases (excluding Target® and Walmart® purchases) on up to $12,000 in the first year. The card also allows you to earn 5% on travel purchases through Chase, 3% at drugstores and restaurants, and 1% on all other purchases.

Moreover, the card will earn you a 5% cash back on expenditures of up to $1,500 in combined purchases in bonus categories each quarter you activate. It has 0% Intro APR for 15 months of account opening on purchases. Thereafter, a variable APR of 14.99 – 23.74% applies. Learn more.

4) Capital One® SavorOne® Cash Rewards Credit Card

The card has no foreign transaction fees. Also, it charges no annual fees whatsoever. Get the card and within the first three months, you earn a one-time $150 cash bonus after you spend $500 on purchases within the first 3 months.

Furthermore, you will be able to earn unlimited 3% cash back on dining at restaurants and entertainment. You will also get a 2% cashback at grocery stores and 1% on all other purchases.

The good thing is that the rewards will not expire. There is no limit on how many rewards you can earn. Again, the card has a 0% intro APR on purchases for 15 months after which a 15.49% – 25.49% variable APR takes effect. Learn more.

5) Wells Fargo Cash Wise Visa® Card

The card has 0% Intro purchases and transfers for 15 months of account opening. It charges no annual fee and this makes it less costly to use it. Get the card and earn unlimited 1.5% cashback on the purchases you make. Also, you will be able to earn a $150 cash rewards bonus when you spend $500 in purchases in the first 3 months of account opening.

The card is completely secure from fraud and you will always get 24/7 monitoring alerts, you are not liable for any fraudulent use of the card. The card requires good/excellent scores. Learn more.

6) Capital One® VentureOne® Rewards Credit Card

Like many others, this card has no annual fees. Also, transactions are free. Get the card and earn a bonus of 20,000 miles once you spend $1,000 on purchases within 3 months. This is equal to $200 in travel tickets. Furthermore, you will be able to earn unlimited 1.25X miles on each purchase every day.

The good thing with this card is that the miles do not expire. Also, you can transfer your miles to over 10+ travel loyalty programs. It has a 0% Intro on purchases for 12 months. Thereafter, you incur a variable regular APR of 15.49% – 25.49%. Learn more.

Bottom line

Credit cards with no interest save you a lot of money. Interest rates translate to huge amounts of money over a long period. However, the 0% interest is a short term promotion as at one time, you will start paying interest rates. People with bad credit scores find it difficult to access credit cards with 0% APR until they grow their scores to ‘good’ or excellent.